WHEN the United States speaks, Australian investors listen.

And they will be doing so very closely as the much-anticipated US rates decision is handed down on Thursday.

Federal Reserve chair Jerome Powell has previously indicated there will be no changes to the cash rate in May, while the bank waits for more information on the effects of recent tariffs.

But what investors are mainly interested in is what comes afterwards, independent economist Craig James says.

“(The decision) shouldn’t have any great impact, providing the Federal Reserve chair indicates that there is still the continued leaning towards interest rate cuts,” he told AAP.

“If it is the case that he winds back the guidance on rate cuts, that could see a degree of disappointment in US markets, and that would have implications for Australian investors as well.”

Commonwealth Bank economists are forecasting the US bank to cut rates by a quarter of a percentage point in each of the next four decision cycles.

But Mr James said the Federal Reserve could take a more cautious attitude, given the impact of the tariffs increasing prices amid a slowing economy which contracted 0.3 percent in the March quarter.

“That’s something that investors certainly don’t like because the question is how does policy react to a stagflation situation?” the economist said.

“Do you increase interest rates to fight inflation, or do you decrease interest rates because the economy is flat or contracting?”

The Bank of England will also hand down its decision on Friday but Australian investors and markets will pay less attention than the “main game” in the US.

Back home, the Reserve Bank will announce its rates decision on May 20, with the door “wide open” for another rate cut, given inflation is under control – rising by 0.7 percent in the March quarter.

“But in this volatile environment, they’re going to be fairly careful in terms of what they indicate about future movements,” Mr James said.

The federal election result could also be a point of market interest.

“Markets love certainty. Investors love certainty,” he said.

Meanwhile, investors on Wall Street have taken comfort from strong economic data and the potential easing of trade tensions between the US and China, with stocks notching a second straight week of gains.

The US economy added 177,000 jobs in April, exceeding expectations, while the unemployment rate held steady at 4.2 percent.

As a result, the Dow Jones Industrial Average rose 564.47 points, or 1.39 percent, on Friday to 41,317.43, the S&P 500 gained 82.54 points, or 1.47 per cent, to 5,686.68 and the Nasdaq Composite gained 266.99 points, or 1.51 percent, to 17,977.73.

Australian share futures jumped 32 points, or 0.38 percent, to 11,481.

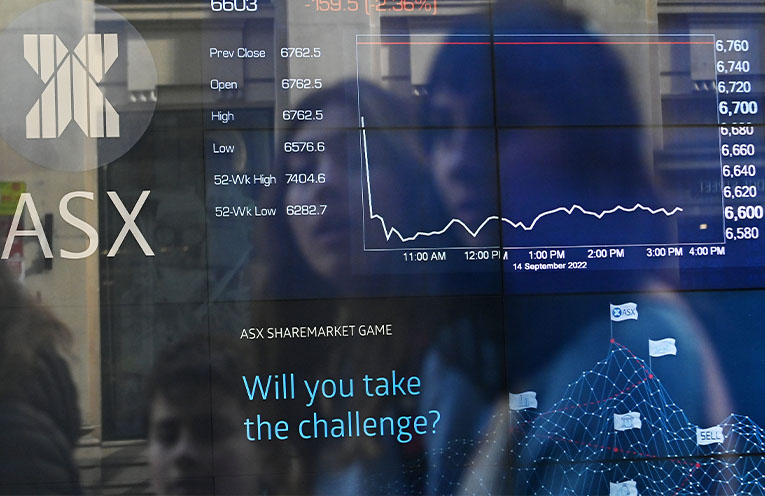

The S&P/ASX200 rose 92.4 points, or 1.13 percent, to 8,238, as the broader All Ordinaries gained 90.5 points, or 1.08 percent, to 8,456.2.

By William TON, AAP